If it appears to be like as in case your funds are spinning uncontrolled, fully the FIRST situation it is best to do is to search out out what you are truly spending. It sounds simple, nonetheless it’s absolutely not, LOL! And I am positive you already know this in case you’re firstly of testing some sort of funds!

In case you haven’t heard of it, YNAB stands for You Want A Funds. YNAB is my secret to sustaining my funds in research, and the correct half is it solely takes me about 10 minutes a WEEK!! Loads a lot much less time budgeting– yay! Within the occasion you wish to see precisely what I do on a on day by day foundation and weekly foundation for budgeting in YNAB, protect discovering out, or try the video correct proper right here.

There are all types of quite a few budgeting methods. I will allow you to perceive why YNAB has labored greatest for me out of all that I’ve tried:

- It is digital. Soooo a lot of my funds are digital. I pay funds on-line or on autopay. I furthermore use credit score rating ranking and/or debit participating in taking part in playing cards nearly absolutely. I not usually use money. So having a money system merely makes no sense for me.

- It’s often cell. I reap the advantages of it a ton on my cellphone, considerably for shortly categorizing funds as they arrive out of my account.

- It is quick. It really takes me about 2 minutes every weekday to categorize funds. It takes me an extra 5-10 minutes every month to set the funds for the approaching month.

- There may be some extra setup time everytime you first begin, however even that solely takes about 20-Half-hour. All the gadgets is as automated because of it may presumably be, and all of that automation saves important time! I in no way ought to re-do one factor!

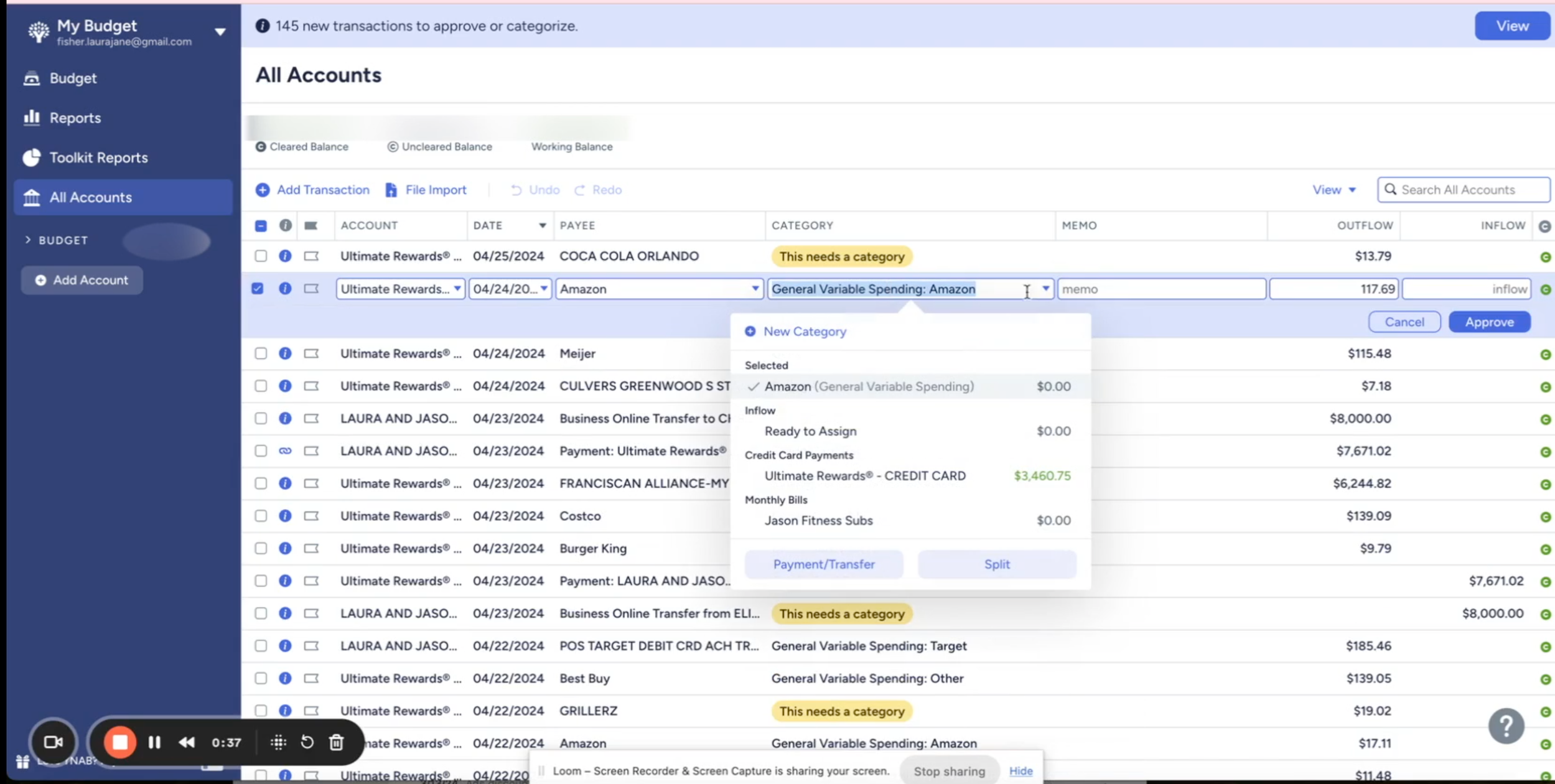

Categorizing Funds

An essential a part of sustaining with YNAB is simply categorizing your funds as they arrive in. I do that significantly bit in a single different method than some. Listed below are the teachings I’ve:

- month-to-month funds

- widespread spending

- numerous sinking funds (saving for particular options)

- consuming out

- giving

- financial monetary financial savings

- investing

- taxes

Most individuals would break up their widespread spending into somethign like this:

- meals/groceries

- cleansing merchandise

- toiletries

- clothes

- residence decor

I uncover that the extra classes I’ve, the extra delicate (and fewer fast and simple!) factors become. If I will have a hope of sticking with one factor, it really should be quick and simple at this diploma in my life! So what I ended up doing as an alternative choice to widespread spending is to separate it into retailers– like Meijer, Goal, Walmart, and so forth.

YNAB implies that you may get as into-the-weeds as you wish to. So I may take my Goal receipt and put $20 into clothes, $50 into groceries, $60 into residence decor….however then I’ve to maintain up my receipt, do the arithmetic, break up all of it out, and so forth. It merely takes quite a few time. I’ve furthermore discovered that I do not really should know what I am spending in every class. Inside the event you do, you may absolutely monitor that. However what factors most to me is that I am not overspending as a complete. I’ve to spend lower than I make, LOL! Nonetheless when one week I spend extra in garments and fewer in toiletries, it really would not matter to me.

Categorizing by retailers is simply very easy and really black-and-white. It takes zero thought to know the place it goes, and because of automation, YNAB categorizes this for me already, and all I’ve to do is go in and approve it swiftly, and I am carried out! I can nonetheless see which retailer I spend primarily basically essentially the most at, and this may be useful. Goal tends to be a “pleasurable” retailer, so whereas I’m going to purchase some groceries there, if I uncover my spending is completely uncontrolled at Goal, groceries are most undoubtedly not the issue, LOL!

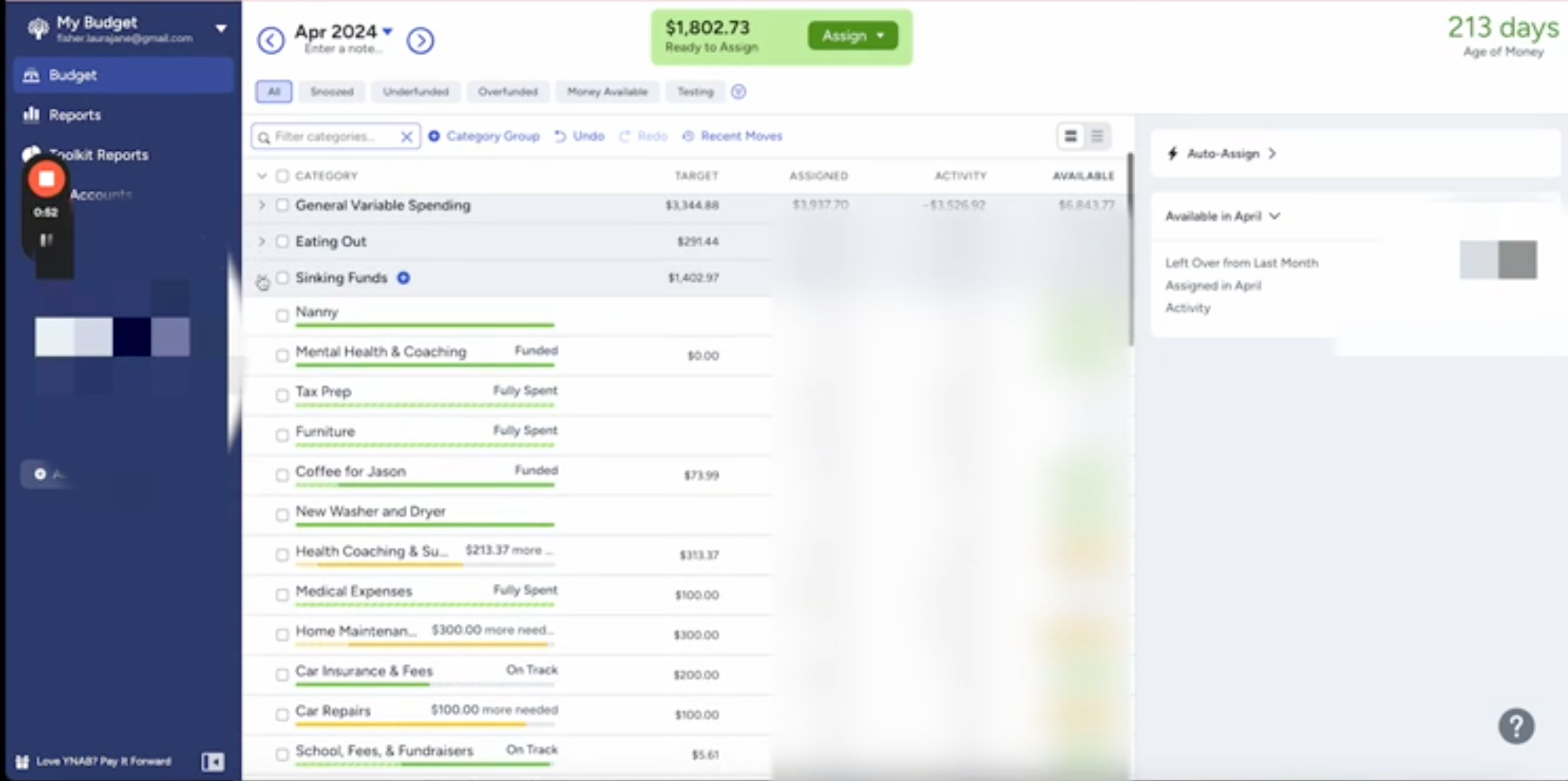

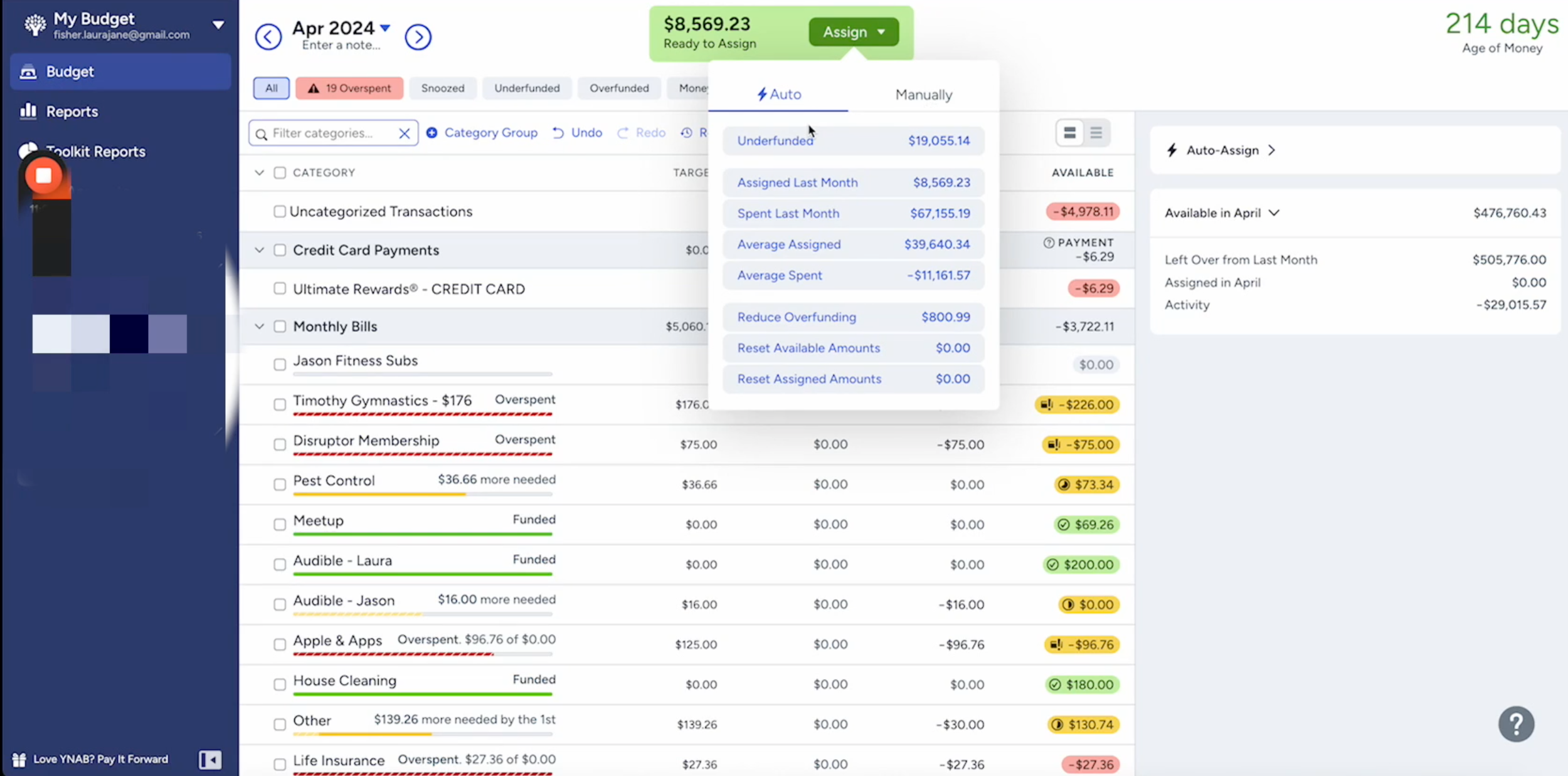

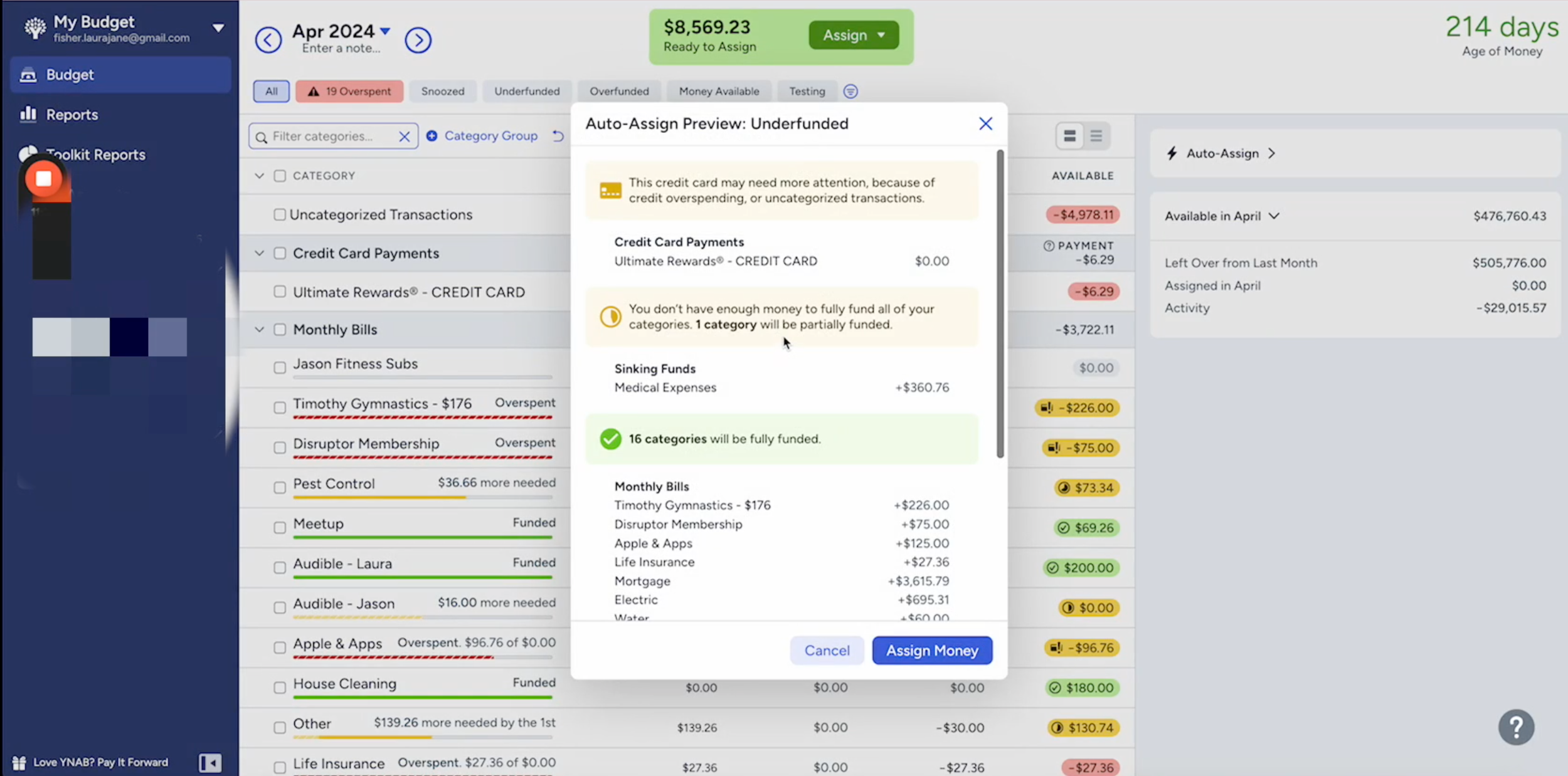

Planning Your Funds

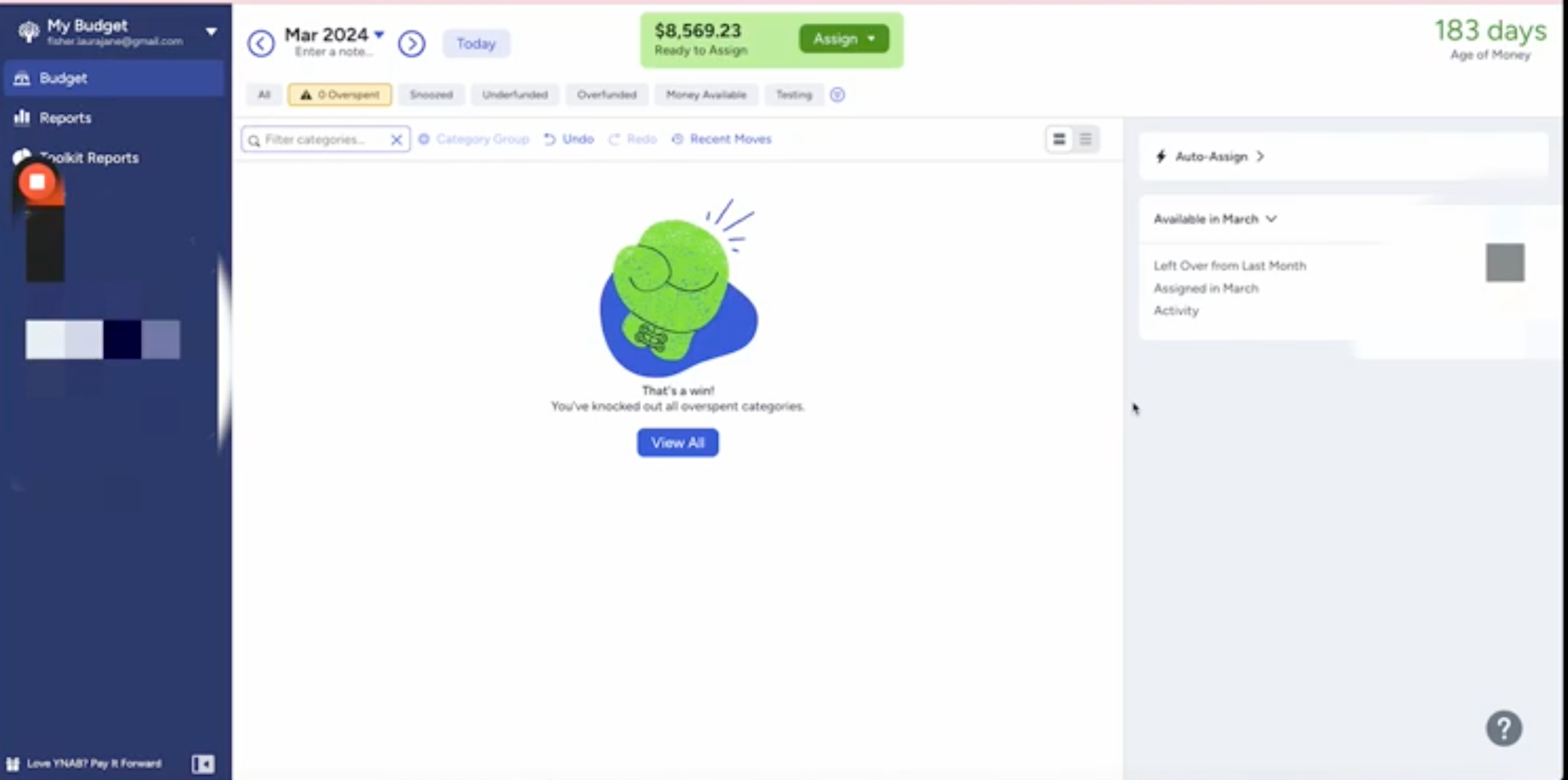

On the top of every month, I’ve to “clear up” the funds after which set the funds for the approaching month. If I overspent in anyone class, I wish to maneuver cash from one completely different class to cowl it. I favor to maintain up a “Life-style” class for this carry out. It is like my “oops” fund. Normally it is used for factors we wish, like a dental invoice, or generally I reap the advantages of it due to we needed to do one issue pleasurable like an unplanned weekend journey. However you don’t want to do that within the occasion you wish to be extra detailed collectively alongside along with your planning than I do. I an similar to organising in some flexibility.

Get a Month Forward (If You Can)

That’s among the many many foundational ideas of YNAB. They actually promote getting a full month forward in order that everytime you begin the month, you are utilizing the cash you have already got that acquired proper right here in final month. This may be considerably useful if you aren’t getting a secure paycheck. This may presumably be for each sort of causes:

- You’re employed on cost.

- Your job has some unpredictable extra time.

- Your hours aren’t the an similar from one week to the subsequent.

Principally, in case your research won’t be precisely the an similar each month or each week, you then would presumably really income from getting a month forward. This vogue precisely how somewhat loads cash it is best to work with, and you are not guessing what’s going on to may be discovered!

Getting a month forward won’t be all the time a brief/simple course of. It will perhaps take quite a few months (or extra) to reside beneath your means ample to get a month forward. It’s so price it, although, and it offers you quite a few peace of concepts in case you do have an unstable earnings.

Targets

That is maybe the one most intricate situation about YNAB. It was one issue I did not really perceive at first, however as shortly as a result of it clicked, factors made somewhat loads extra sense! Targets are primarily financial monetary financial savings targets. You could possibly need a particular purpose or a purpose stability you make an try to hit. So, possibly you are saving for a go to that is going to price $2600. Whilst you hit that take into consideration, YNAB routinely stops you from funding that additional. Or in case your emergency fund is totally funded at $5000, when you hit that purpose, no extra money goes in.

One situation I might counsel although, is that when you may have a car worth, proceed paying that “worth” correct proper right into a sinking fund so hopefully you may pay money for the subsequent car and certainly not ought to pay out cash in curiosity subsequent time.

Inside the event you occur to not have ample to fund your entire targets on the cost you usually contribute, then YNAB will allow you to perceive. You will then resolve to skip funding or pull it from elsewhere. Normally it is okay to cease funding. If now we now have an exquisite cushion in our medical fund, it is okay to skip a pair months. However in case you do that indefinitely, it may lastly come as soon as extra to chew you, in precise truth.

I truly like how atmosphere pleasant YNAB is for budgeting. However most essential– it is quick and simple to make the most of!! A system solely works in case you put it to use, so one factor we’re going to do to make it extra probably that we’ll truly do one issue, the higher! That is not the least bit a tutorial on suggestions on simple strategies to make use of YNAB. They really have GREAT movies for that on their very private website and YouTube channel. However I get soooo many questions on budgeting that I believed it was time to allow you to perceive all what I reap the advantages of and why it truly works for me. Hopefully YNAB may help only a few of you as appropriately!

Group that actually sticks for busy, glad lives